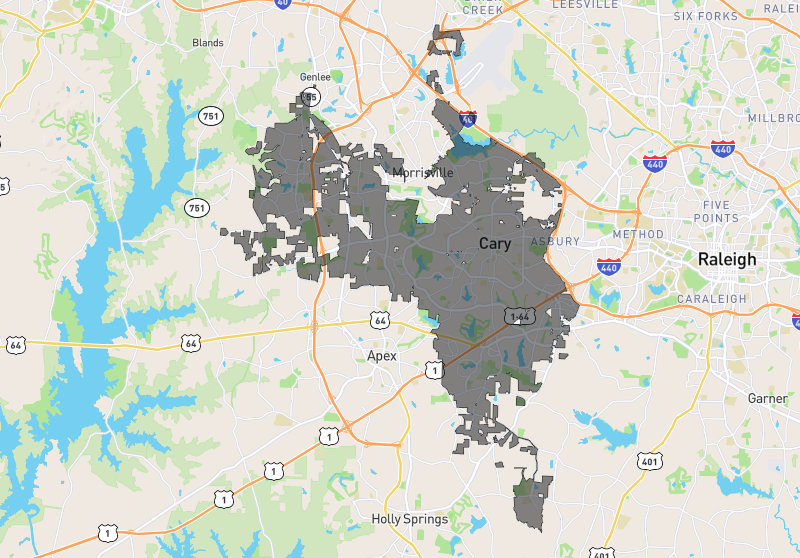

Cary’s Housing Market Enters Spring in Rare Balance: A Tier‑by‑Tier Breakdown

Cary, NC is heading into the spring real estate season with a market that looks very different from the frenzied years of 2020–2022. Prices have softened, inventory has expanded, and buyers and sellers are meeting on more equal footing. Yet Cary’s long‑term fundamentals—jobs, schools, and in‑migration—remain among the strongest in the Southeast.

To understand where the market is truly heading, it’s helpful to break Cary’s housing landscape into three segments: low‑end, mid‑range, and high‑end. Each tier is behaving differently, and those differences will shape the spring season.

1. Market Overview: A Return to Balance

Across all price points, Cary is showing signs of normalization:

Median sale price: roughly $550K–$585K, depending on data source

Year‑over‑year price movement: down 6–11%

Inventory: up sharply, with some sources showing 70%+ increases

Days on market: generally 49–75 days, depending on neighborhood and price tier

Sale‑to‑list ratio: around 98–99%, indicating realistic pricing and modest negotiation room

This is not a downturn—it’s a recalibration. Cary’s market is shifting from overheated to sustainable, and spring will likely reinforce that trend.

2. Low‑End Market (Under ~$450,000)

Who’s buying:

First‑time buyers, downsizers, and investors.

What’s happening:

The low‑end market remains the most competitive segment in Cary, simply because supply is extremely limited. Cary’s growth and rising land values have made it difficult for builders to deliver new homes at this price point, and existing owners often hold onto these properties because they’re affordable and easy to rent.

Key Metrics:

Inventory: still tight, even with overall market increases

Days on market: often under 30 days for well‑maintained homes

Sale‑to‑list ratio: frequently 100%+ for move‑in‑ready properties

Investor activity: steady, especially for townhomes and smaller single‑family homes

Spring Outlook:

Expect continued competition. Buyers will see more options than last year, but anything priced under $450K in good condition will still move quickly. Sellers in this tier retain a mild advantage.

3. Mid‑Range Market ($450,000–$850,000)

Who’s buying:

Move‑up buyers, relocating professionals, and families targeting top school zones.

What’s happening:

This is the segment where Cary’s “balanced market” is most visible. Inventory has expanded significantly, giving buyers more choice and reducing the pressure to rush. Homes are still selling, but the pace is more measured, and pricing strategy matters.

Key Metrics:

Inventory: up dramatically—some data shows 60–80% YoY increases

Days on market: typically 45–60 days, depending on neighborhood

Sale‑to‑list ratio: around 98–99%

Price adjustments: common when sellers overreach

Spring Outlook:

This tier will define Cary’s spring season. Buyers have room to negotiate, but sellers who price correctly will still see steady activity. Homes in established neighborhoods like Lochmere, Preston, and Amberly will outperform the broader market.

4. High‑End Market ($850,000 and up)

Who’s buying:

Executives, out‑of‑state relocators, and luxury‑focused buyers seeking space, amenities, or new construction.

What’s happening:

The high‑end market is the softest segment heading into spring. Luxury inventory has grown faster than demand, and buyers in this tier tend to be more selective and less rate‑sensitive. New construction—especially in West Cary—adds competition for resale homes.

Key Metrics:

Inventory: high and rising

Days on market: often 60–90+ days

Price reductions: increasingly common

Sale‑to‑list ratio: can dip to 96–98%, depending on condition and location

Spring Outlook:

Luxury sellers should expect longer marketing times and more negotiation. Buyers, on the other hand, will find the best selection and the most leverage in years.

5. Rental Market: A Parallel Story

Cary’s rental market is also shifting:

Median rent: around $1,660, up modestly

Rental inventory: up 30–40% YoY

Demand: steady due to job growth and relocations

For investors, this means more competition but also more opportunities to acquire properties at softened prices.

6. What This Means for Spring

For Buyers

More inventory = more choice

Negotiation power is back, especially in the mid‑ and high‑end tiers

No need to waive contingencies or rush

For Sellers

Pricing must reflect current conditions

Homes need to be market‑ready

Expect offers near list price, not above

For Investors

A rare window to buy in Cary at softened prices

Strong long‑term fundamentals support appreciation

Rental demand remains durable

The Bottom Line

Cary’s housing market is entering spring in a state of healthy balance. The frenzy has cooled, but demand remains strong. The low‑end market is still competitive, the mid‑range is stabilizing, and the high‑end is adjusting to increased supply. For the first time in years, buyers and sellers are operating on relatively equal footing.